Why Australian Imports Remain Cost-Effective for the U.S.

Despite the Trump administration’s renewed protectionist stance on trade, Australian imports continue to offer strong value for U.S. businesses. While tariffs introduced earlier this year have reshaped global trade dynamics, Australia remains a cost-effective and reliable supplier — particularly in key sectors like industrial equipment and agricultural technology.

In March 2025, President Donald Trump reintroduced a sweeping 10 percent tariff on most imported goods, coupled with a 25 percent tariff on targeted categories such as steel and aluminium. While this triggered immediate concerns across the business community, Australia has largely avoided the harshest penalties. In fact, tariff rates on Australian goods remain significantly lower than those applied to imports from China, which currently face duties ranging from 25 to 40 percent depending on the category. Industrial components, electronics, and raw materials from China have been particularly affected, prompting many U.S. firms to reassess their supply chains.

Australia, by contrast, benefits from the long-standing Australia–United States Free Trade Agreement (AUSFTA), which continues to provide favourable treatment for a broad range of goods. While certain sectors have not been entirely spared under Trump’s trade orders, many Australian exports still enter the U.S. under reduced duty classifications — particularly in areas of mutual strategic value like mining equipment, precision manufacturing, and agricultural tools.

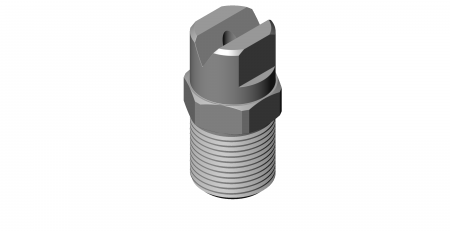

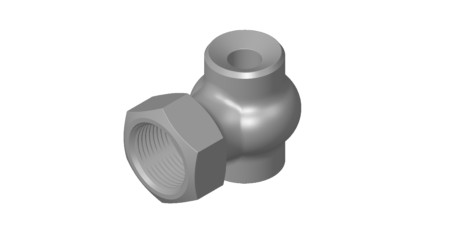

One standout sector is industrial equipment, especially components used in broadacre farming, horticulture, viticulture, and irrigation. Spray nozzles — critical parts used in pesticide and fertiliser application — have emerged as one of the most in-demand imports from Australia. Australian-manufactured spray nozzles are renowned for their engineering precision, durability, and compatibility with a wide variety of farming systems. From high-efficiency drift reduction nozzles to advanced variable rate spray systems, U.S. agricultural suppliers are increasingly turning to Australian manufacturers to fill orders that would previously have been met by European or Chinese factories now subject to higher tariffs and uncertain shipping conditions.

American importers have found Australian spray nozzles particularly appealing not only because of their quality, but because of the minimal compliance effort required. Products often arrive ready for immediate deployment, meeting all relevant Environmental Protection Agency (EPA) and U.S. Department of Agriculture (USDA) standards. This saves time, reduces inspection risk, and allows U.S. distributors to maintain fast-moving inventories, particularly in regions where tight planting and spraying windows require just-in-time delivery.

Pricing also remains favourable thanks to foreign exchange conditions. The Australian dollar is currently trading at around 65 U.S. cents, providing a built-in discount for American importers. For example, a shipment of AUD 50,000 worth of spray nozzles equates to approximately USD 32,500. Even after applying the 10 percent general import tariff, total costs still fall well below comparable goods sourced from countries where both currency values are stronger and tariffs are higher.

Logistics have further supported cost-efficiency. Many Australian exporters now offer consolidated freight solutions or free shipping on bulk orders, particularly for repeat customers or those partnering through third-party logistics hubs. Regular shipping routes from major ports like Melbourne and Brisbane to Los Angeles, Houston, and Seattle have created a reliable pipeline for industrial goods. In many cases, importers are able to secure Delivered Duty Paid (DDP) terms or free-on-board arrangements that allow full cost visibility from factory floor to U.S. warehouse. This certainty is especially valuable when managing equipment supply during planting or harvest season, where delays can translate into lost productivity.

Another factor driving the preference for Australian industrial imports is political and operational stability. Compared to regions like Southeast Asia or Eastern Europe, Australia offers greater transparency, fewer supply chain shocks, and consistent adherence to contract terms. For U.S. companies with compliance-heavy operations or strict delivery targets, these qualities help reduce risk and avoid unexpected disruptions.

While much of the media focus around trade with Australia has traditionally centred on beef, wine, and wool, the real growth in 2025 is being seen in high-value manufactured goods. Precision parts, irrigation systems, sensor technologies, and agricultural spray components are carving out a significant share of the U.S.–Australia trade corridor.

Ultimately, despite new tariffs under Trump’s policies, Australian imports continue to make financial and operational sense for American businesses. The combination of lower tariffs compared to China, favourable exchange rates, shipping flexibility, and high-quality industrial manufacturing means U.S. importers in the agricultural and industrial sectors are well positioned to maintain — or even grow — their sourcing from Australia. In a volatile global trade environment, Australia remains a cost-effective and low-risk partner.

Leave a Reply